Trading Tutorial

Underlying tokens deposited in pools, exclusively for trading, are mandatorily compliant tokens of ERC20.

If you are players used to trading using regular, derivative exchanges around the world, you may be surprised that your scenarios aren't completely supported out of the box.

Upon Shorter’s trading relays, an efficient algorithm named WGT (Weighted Graph Routing) is serving along the exchange pathway. It makes general and crystal suppression to trader’s ordering payout, outstrip the existing decentralized infrastructures.

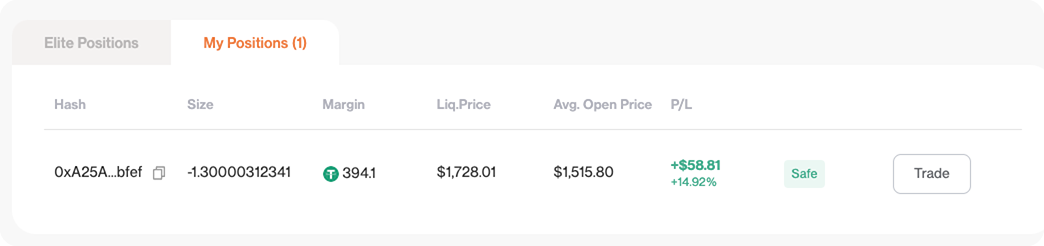

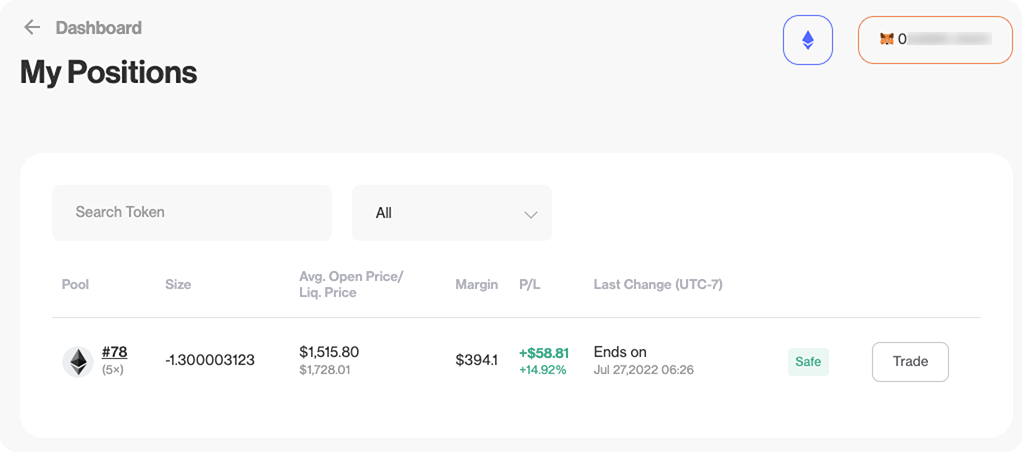

There are two ways to view your positions.

- Pool detail page(i.e. #1, #107). The positions held by you are showing in the Position pane.

- On My positions (opens new window) page listing all your positions meticulously that you can readily comb them by clicking on the "My positions" from dashboard.

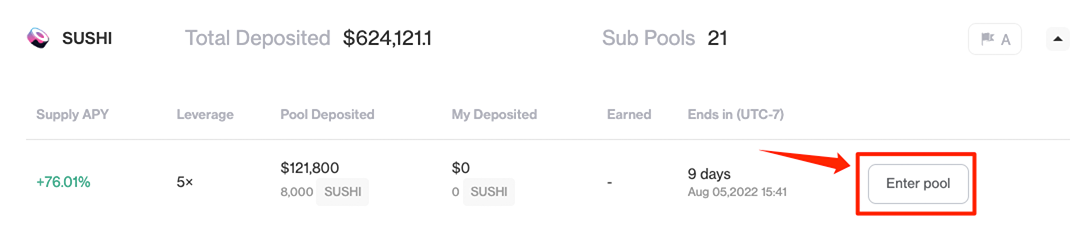

Sell Short

Before you can short one specified token, you will need to pick the desired pool on the Pools (opens new window) page or filter the corresponding pool out by any keyword, then hit the "Enter pool":

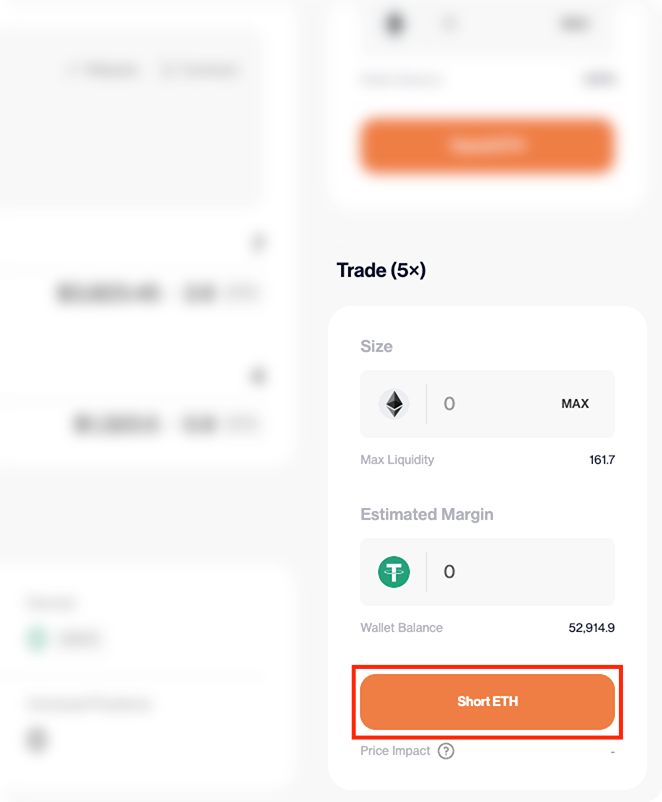

On this pool detail page, the trading pane is displayed on the right side. Enter the amount you are prone to borrow from the pool, ensuring you have an equivalent of USD(s) token in your wallet for the sequent setting up:

Hit on "Short XXX" to open the initial position.

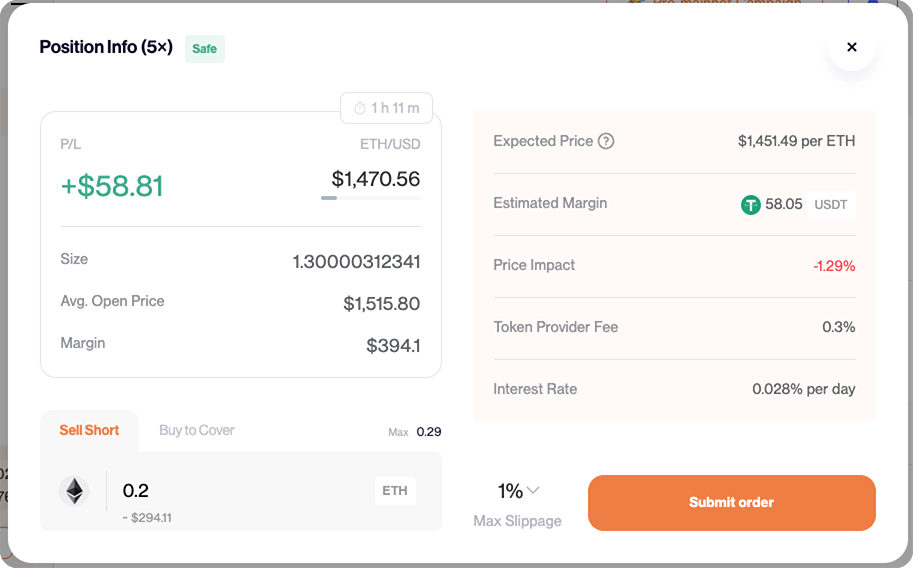

If you are currently holding any position, there’s a much easier way to directly sell short at the same token and leverage. In the Position Info box switching to the "Sell short" tab, enter the size to increase.

Click "Submit order".

Buy to Cover

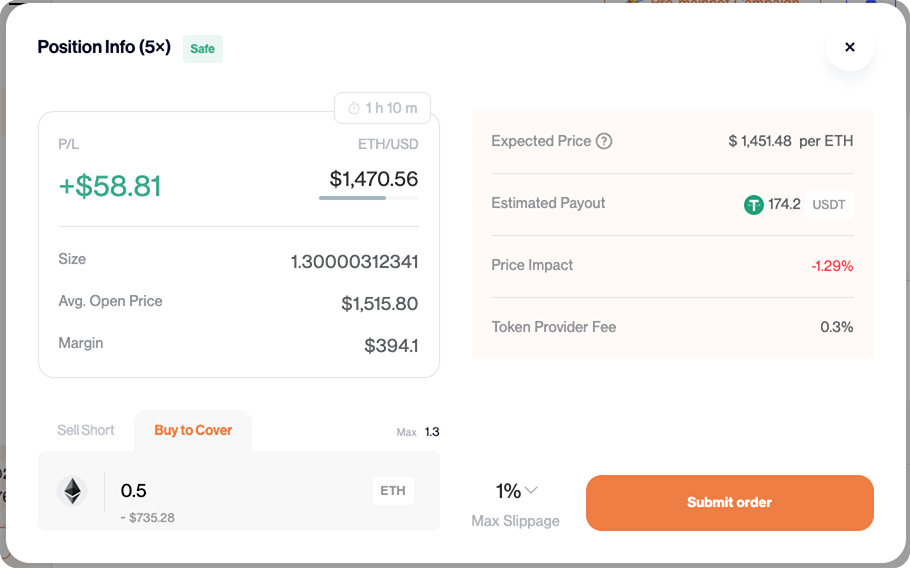

Pick one position which size you'd like to decrease, click "Trade". In the Position Info box, you can now decide the size to minus(buyback), with your assessment of the market condition, or the liquidity risk.

Click "Submit order".